Monthly

Stainless Trivia

Fill in your answer below

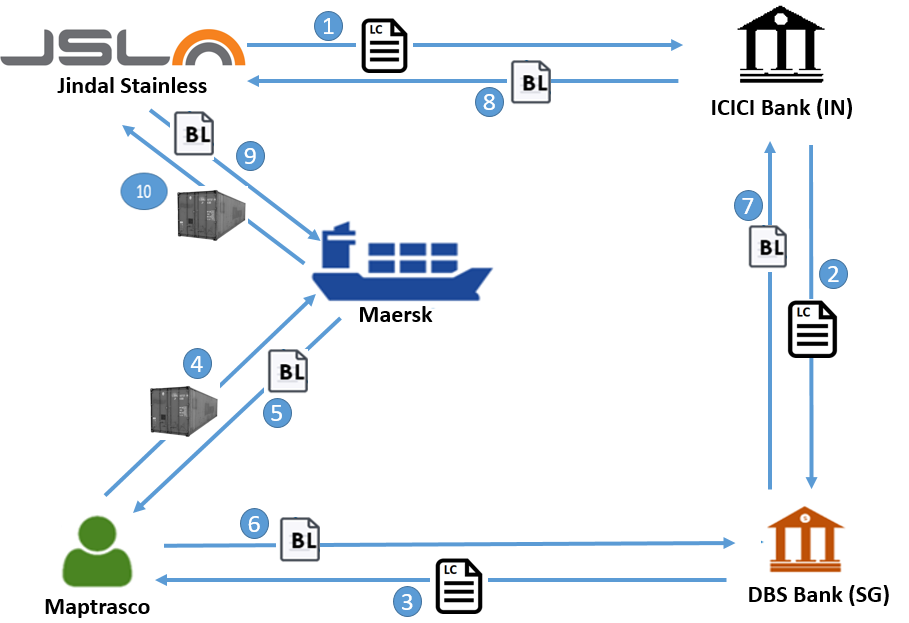

New Delhi, August 25, 2023: Jindal Stainless is the first Indian corporate participating in a path-breaking India-Singapore project to make the bilateral cross-border trade paperless and a smooth ride for all parties. Commerce and Industry Minister Mr Piyush Goyal and his Singaporean counterpart, Mr Gan Kim Yong, today successfully kicked-off the first “live” transaction of interoperable e-Bills of Lading (eBLs) from Singapore to India through TradeTrust Framework, during the G20 Trade and Investment Ministerial meeting in Jaipur, India.

The National Institute for Transforming India (NITI) Aayog and Singapore’s Ministry of Trade and Industry (MTI) have roped in, besides Jindal Stainless, ICICI Bank, Enterprise Singapore, Infocomm Media Development Authority (IMDA), DBS Bank, Maptrasco, A P Moller-Maersk for this project.

Globally, this is the first live transaction under letter of credit utilizing eBLs in this project, powered by blockchain, under which the traders, shippers and banks are involved in the transaction of an actual shipment that will be fully paperless across geographies and through different platforms.

Expressing his endorsement of the project, Managing Director, Jindal Stainless, Mr Abhyuday Jindal, said, “The TradeTrust Framework will boost international trade by eliminating the massive time consumed in the physical movement of the paper bill of lading (BL), and allows digital transfer of the title of goods from the seller to the buyer. As a major importer of scrap as a raw material, interoperable eBLs will benefit us with speedy release of goods at the port, ensure cost effectiveness and unlock liquidity for business. We are proud to be partnering with the Indian and Singapore government in helping build an ecosystem for efficient international trade which we hope will only become more widespread in the long run.”

eBLs have emerged as a promising solution to addressing the challenges faced in international trade by digitising the traditional paper-based process, allowing for faster and more secure transfer of ownership and title documents in the shipping process. Besides minimising the risk of demurrage and detention of goods, the usual pain points for importers, they enhance trade financing opportunities and reduce risk of any damage to or loss of paper documents. eBLs also streamline the documentation process and increase operational efficiency and accuracy besides having a reduced carbon footprint.

About Jindal Stainless

India’s leading stainless steel manufacturer, Jindal Stainless, has an annual turnover of INR 35,700 crore (US $4.30 billion) in FY23, and an annual melt capacity of 3 million tonnes. It has two stainless steel manufacturing facilities in India, in the states of Odisha and Haryana, and an overseas unit in Indonesia — this unit serves the markets of South-East Asia and nearby regions. Jindal Stainless has a worldwide network in 15 countries and one service center in Spain. In India, there are 10 sales offices and six service centers. The Company’s product range includes stainless steel slabs, blooms, coils, plates, sheets, precision strips, blade steel, and coin blanks.

Integrated operations have given Jindal Stainless the edge in cost competitiveness and operational efficiency, making it one of the world’s top five stainless steel players (ex-China). Founded in 1970, Jindal Stainless continues to be inspired by a vision for innovation and enriching lives and is committed to social responsibility. The Company boasts of an excellent workforce, value-driven business operations, customer centricity and the best safety practices in the industry.

Jindal Stainless remains committed to a greener, sustainable future, fuelled by environmental responsibility. The company manufactures stainless steel using scrap in an electric arc furnace, the least greenhouse gas emission route since it enables 100% recyclability with no reduction in quality, thereby achieving a circular economy. The company aims to reduce carbon emission intensity by 50% until FY 2035 (from FY 2022 baseline levels of 1.91 tonnes CO2/tonnes of crude steel) and achieve Net Zero by 2050.