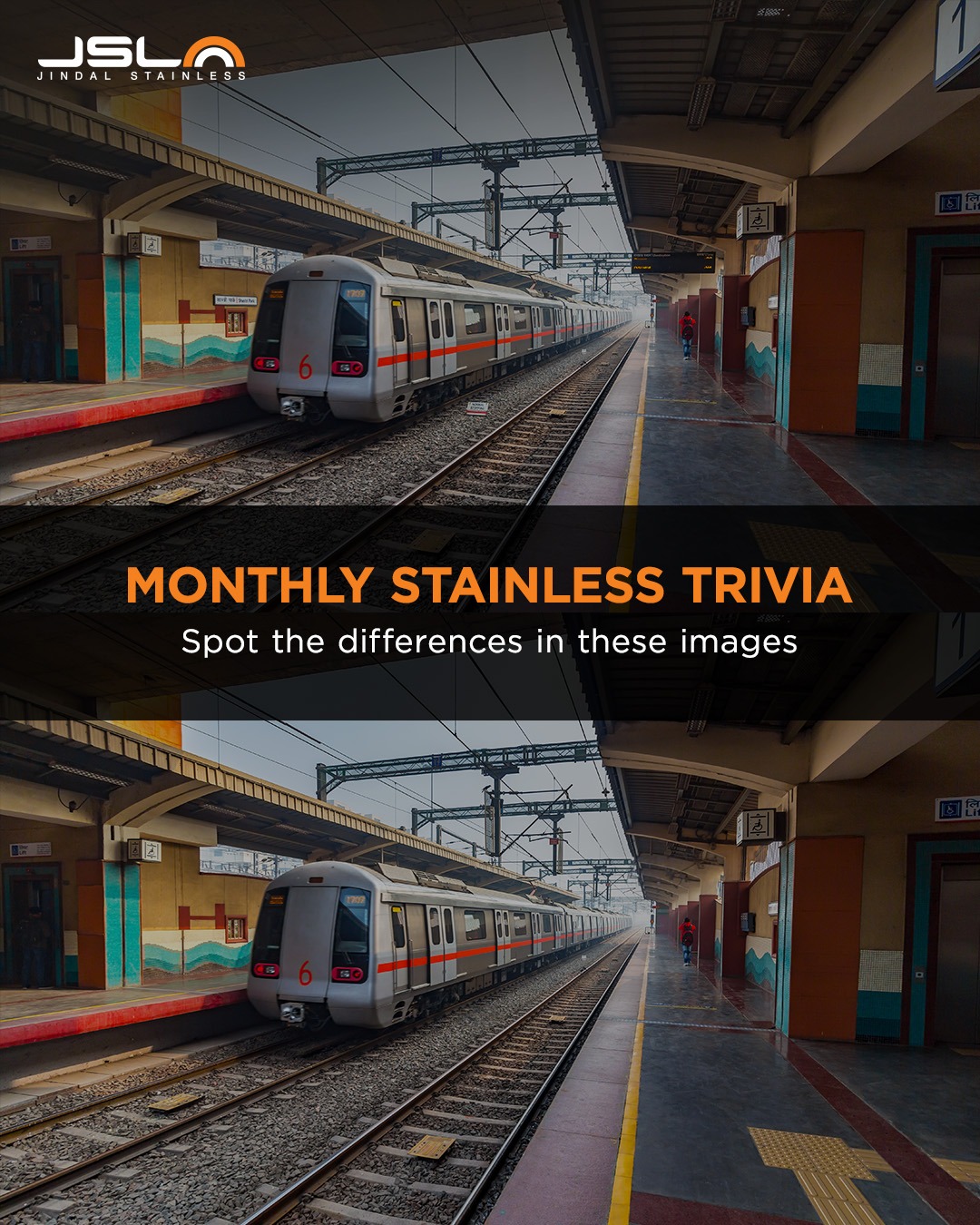

Monthly

Stainless Trivia

Fill in your answer below

| FY24 highlights |

|---|

Standalone Performance: Sales volume at 21,74,610 tonnes, up by 23% YoY Net revenue at INR 38,356 crore, up by 9% YoY EBITDA at INR 4,036 crore, up by 13% YoY PAT at INR 2,531 crore, up by 26% YoY Consolidated Performance: Net revenue at INR 38,562 crore, up by 8% YoY EBITDA at INR 4,704 crore, up by 31% YoY PAT at INR 2,693 crore, up by 29% YoY |

| Q4FY24 highlights |

Standalone Performance: Sales volume at 5,70,362 tonnes, up by 12% YoY Net revenue at INR 9,521 crore, nearly the same as YoY EBITDA at INR 827 crore, down by 25% YoY PAT at INR 476 crore, down by 28% YoY Net debt at INR 2,418 crore Net debt-to-equity ratio at ~0.18 Consolidated Performance: Net revenue at INR 9,454 crore EBITDA at INR 1,035 crore, down by 10% YoY PAT at INR 501 crore, down by 30% YoY |

New Delhi, May 15, 2024: The Board of Directors of Jindal Stainless Limited (JSL) today announced the financial results for the quarter and financial year ended on March 31, 2024. The company recorded sales at 21,74,610 tonnes, a jump of 23% over FY23. On a standalone basis, net revenue rose by 9% on a YoY basis, at INR 38,356 crore. With FY24 EBITDA recorded at INR 4,036 crore and PAT at INR 2,531 crore, their corresponding YoY growth was to the tune of 13% and 26% respectively.

Owing to the government’s push for various infrastructure projects such as Gati Shakti, demand for stainless steel grew consistently throughout the quarter. Sales delivered strong performance across the automobile, wagons, coaches, metro, pipes & tubes, and other segments. Production of TMT rebar from the Rathi Super Steel Limited facility gained traction, and the company rolled out over 3,000 tonnes of stainless steel rebars in FY24.

The Board of Directors of Jindal Stainless recommended a final dividend payment @INR 2 for FY24 subject to approval of shareholders, taking the total dividend payment to INR 3 i.e. 150% per equity share with a face value of INR 2 each. Net debt as on March 31, 2024, stood at INR 2,418 crore, decreasing by 22% over the previous quarter. This led to an improvement in the net debt-to-equity ratio, recorded at 0.18.

Backed by continued and strong domestic demand, sales volume in Q4FY24 grew to 5,70,362 tonnes, up by 12% on a YoY basis, the highest ever recorded for any quarter. While net revenue grew marginally to INR 9,521 crore, EBITDA and PAT registered a dip of 25% and 28% respectively. Margins remained under pressure on account of negative inventory valuation due to continuously falling nickel prices. Key export markets, such as Europe and the US, also remained weak. The Red Sea crisis during the quarter further led to a steep increase in ocean freight and constrained availability of containers, consequently compressing margins.

Domestic/export mix

| Geographical Segment | Q4FY24 | Q3FY24 | FY23 | FY24 |

| Domestic | 89% | 88% | 89% | 87% |

| Export | 11% | 12% | 11% | 13% |

Financial performance summary (figures in INR crore)

| Particulars | Standalone | |||||||

|---|---|---|---|---|---|---|---|---|

| Q4FY24 | Q3FY24 | Change (Q-O-Q) |

Q4FY23 | Change (Y-O-Y) | FY24 | FY23 | Change (YoY) | |

| SS Sales Volume (MT) | 5,70,362 | 5,12,015 | 11% | 5,07,632 | 12% | 21,74,610 | 17,64,405 | 23% |

| Net Revenue | 9,521 | 9,088 | 5% | 9,444 | 1% | 38,356 | 35,030 | 9% |

| EBITDA | 827 | 1,021 | -19% | 1097 | -25% | 4,036 | 3,567 | 13% |

| PAT | 476 | 779 | -39% | 659 | -28% | 2,531 | 2,014 | 26% |

| Particulars | Consolidated | |||||||

| Q4FY24 | Q3FY24 | Change (Q-O-Q) |

Q4FY23 | Change (Y-O-Y) | FY24 | FY23 | Change (YoY) | |

| Net Revenue | 9,454 | 9,127 | 4% | 9,765 | -3% | 38,562 | 35,697 | 8% |

| EBITDA | 1,035 | 1,246 | -17% | 1,144 | -10% | 4,704 | 3,586 | 31% |

| PAT | 501 | 691 | -28% | 716 | -30% | 2,693 | 2,084 | 29% |

The imports from China continue to surge, with Q4FY24 figures reported around 1,40,000 tonnes, a ~20% increase on a YoY basis. With consistent increase in Chinese dumping, the stainless steel market in India continues to be flooded by substandard exports, threatening the MSME sector and disrupting the level playing field needed for fair competition and further innovation.

Other key developments:

- Recently, Jindal Stainless announced major acquisition and expansion plans to the tune of INR ~5,400 crore to augment its melting and downstream facilities in order to reach a capacity of 4.2 million tonnes per annum (MTPA). This included a 49% partnership in a joint venture for a 1.2 MTPA stainless steel melt shop in Indonesia; expansion in downstream capacity in Jajpur, Odisha; and acquisition of a 54% equity stake in Chromeni Steels in Mundra, Gujarat. The joint venture in Indonesia promises optimal speed and ensures the security of raw materials, while the expansion of the Jajpur lines will provide added value for both domestic and international customers. Additionally, the cold rolling mill at Chromeni will not only extend the company’s reach within India and overseas but also strengthen its position in the value-added market segment for the foreseeable future.

- Sustainability and ESG:

- JSL inaugurated India’s first Green Hydrogen Plant in the stainless steel sector in March 2024. This plant produces 90 Nm3 of green hydrogen per hour, which will reduce 2,700 tCO2e of carbon emissions annually.

- In an effort to achieve Net Zero by 2050, the company successfully reduced 76,000 tonnes of CO2 in FY24, taking the overall reduction of CO2 to 2.8 lakh tonnes in the last three fiscals.

- JSL also made its official commitment to the near-term science-based emissions reduction and Net Zero targets outlined by the global climate action body Science-Based Targets initiative (SBTi), in a significant step towards achieving carbon neutrality in April 2024.

- The company signed an MoU with IIT Kharagpur in April 2024 to work together on metallurgical projects, such as process optimisation, materials characterisation, and primary alloy production.

- Bolstering the Atmanirbhar Bharat mission of the Hon’ble Prime Minister of India, the company supplied stainless steel for India’s first underwater metro line in Kolkata in March 2024.

- JDA:

- JSL’s strategic arm, Jindal Defence and Aerospace (JDA), successfully developed and supplied for the first time 3 mm special alloy steel sheets for structural application in the Supersonic Missile-Assisted Release of Torpedo (SMART) system, aimed at enhancing the Indian Navy’s anti-submarine warfare capabilities.

- JDA also provided low alloy steel cold rolled grade sheets tailored for the small motor casings of satellite launch vehicles.

- Jindal Stainless partnered with JBM Auto Ltd., the country’s largest electric bus manufacturer, for the fabrication of over 500 energy-efficient and lightweight stainless steel electric buses in March 2024.

- Strengthening the stainless steel ecosystem, in FY24, JSL conducted 133 Fabricator Training Programmes (FTPs), which provided training to 14,508 fabricators vis-à-vis 74 FTPs done in FY23 training 6,692 fabricators. In Q4FY24 alone, 46 FTPs were conducted in various states across India. 5,800+ fabricators attended these sessions and took training on best practices for stainless steel fabrication.

- Awards and recognition:

- JSL won the International Safety Award from the British Safety Council, the most prestigious award in the field of safety, for both the Jajpur and Hisar units.

- The company was also awarded by Hon’ble Cabinet Minister, Labour & Employees’ State Insurance department, Shri Sarada Prasad Nayak for excellent performance in ‘Industrial Safety and Occupational Health’ in Odisha.

Management Comments:Commenting on the performance of the company, Managing Director, Jindal Stainless, Mr Abhyuday Jindal, said, “The last financial year has been an encouraging one. Riding strong on the Indian growth story, we have met our growth projections, and have recently added a new chapter to our expansion plans. This growth is underpinned by a sharp focus on operational efficiency, digitalization programs, people empowerment initiatives, market development, and customer satisfaction strategies. We continue to remain bullish on the Indian market while aiming to maintain our leadership position and ensuring sustainability in sourcing, processes, and products.”